“Am I Saving Enough?” Wealth Formulas to Help You Answer that Question

By Brandon Rotsky, Wealth Advisor & CFP®

April 11, 2022

Wealth is a function of how much you save rather than how much you make. Those who have income that exceeds their expenses, then save and invest the difference are setting themselves up on a path to successful wealth accumulation. The simplicity of this formula—spend less than I earn and save the difference—can lead to a more profound fundamental question that everyone has once asked themself: am I saving enough?

The Certified Financial Planner™ Board has a few general guidelines that can provide benchmarks to measure if you’re on the right track with your savings and expenses. It’s important to remember that it should be taken with a grain of salt with any general rule of thumb, as everyone’s path to financial wellness is different. Remember, personal finance is personal.

Savings is what’s left over from how much you’ve spent in relation to your income. Rather than focusing on minor costs like how frequently we buy coffee or avocado toast, let’s start by focusing on the impact our largest expenditures have on our income: the cost of housing. Whether you buy or rent, housing is a fundamental basic human need. How much we spend on satisfying this need can significantly affect our ability to allocate resources to funding other important financial life goals. The following wealth accumulation formulas come from The Fundamentals of Financial Planning, 5th Edition, by Michael A Dalton, James F. Dalton, Joseph M. Gilice, and Thomas P. Langdon. The first formula to keep in mind when considering your housing expense is:

Annual Housing Costs / Gross Income ≤ 28%

Annual housing costs include mortgage or rent payment, homeowners insurance, HOA fees, property taxes, any expense related to the domicile in which you live. You should aim to keep annual housing costs less than 28% of whatever your gross income is¹. This is important to keep in mind when shopping for a first home or moving to a new apartment to rent. Zillow tracked that the value of a typical US Home dramatically increased compared to the median income of a US full time worker². Potential new homeowners should consider how much of their gross income will be dedicated to satisfying a potential new mortgage.

After home expenses, the most significant expenditures for many individuals and couples are consumer debts. Consumer debt can include credit card payments, monthly car payments, and student loans. Therefore, the second ratio to keep in mind is:

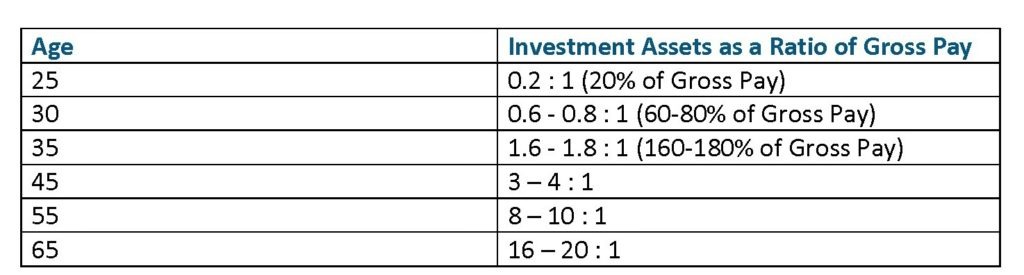

The amount of your annual gross income devoted to fixed expenses like housing costs and consumer debt should be no more than 36% (Dalton, Dalton, Gilice, & Langdon, 2015). In addition, federal student loan repayment plans are set to begin again in May. Keep in mind the impact these resumed payments could have coupled with any new housing costs you may have added to your financial situation in the last year. This will greatly impact how much you can afford to save. The fundamental question behind this article is am I saving enough? While everyone’s financial life plan will be unique and applicable only to themselves, there is an excellent benchmark to measure if you are on the right track with your saving. Below is a table that outlines a benchmark for investment assets as a ratio of gross pay by age (Dalton, Dalton, Gilice, & Langdon, 2015):

Accumulating wealth includes managing expenses so that you can invest the difference between what you earn and what you spend. You have infinitely more control over how much you’ll spend than how your investments will perform. Find a Wealth Advisor that can work with you to determine how these ratios impact your current financial situation or how they will change based on any upcoming goals you are hoping to achieve. Equally important is finding the Wealth Advisor where your relationship is built on an understanding of investment of time, understanding and trust.

If you’ve ever asked yourself, “am I saving enough?” now is a great time to reach out to Wealth Advisor to provide you with the necessary guidance to answer that question.

Brandon Rotsky is a Wealth Advisor and CERTIFIED FINANCIAL PLANNER™ with SAGE Private Wealth Group. Brandon is passionate about empowering his peers to take ownership of their financial well-being. When he’s not cheering on the Cleveland Browns or Ohio State Football team, you can find him at a local dog park with his black-lab, Memphis.

About SAGE Private Wealth Group:

SAGE Private Wealth Group is an Investment Advisory firm located in Oak Brook Terrace, Illinois.

Our mission is threefold:

- Inspire, nurture and challenge each other to hone our gifts and find what makes our work fulfilling.

- Provide sage financial guidance that is fueled by expertise, discipline, and a conviction to do the right thing.

- Create an ethical cycle that empowers women and children through education and access to capital through microfinance.

Our passion is rooted in supporting our team who then take care of our clients so that together we serve our communities.

Our team of dedicated CERTIFIED FINANCIAL PLANNER™ (CFP®) professionals professionals work with our clients to manage and preserve their wealth while helping them build their financial legacies.

¹Dalton, Michael; Dalton, James; Gilice, Joseph; Langdon, Thomas. Fundamentals of Financial Planning. Fifth Edition, Money Education, 2015

²Friedman, Nicole. “Homes Earned More for Owners Than Their Jobs Last Year.” The Wall Street Journal, 17th March, 2022, https://www.wsj.com/articles/homes-earned-more-for-owners-than-their-jobs-last-year-11647518400